–News Direct–

In their 8th State of European FinTech report, Finch Capital takes a closer look at three core areas and provides an analysis of the sector with a forecast of trends that will likely emerge including: (1) Impact of Investment Environment on the State of European FinTech, (2) State of FinTech of key European Countries and (3) Thematic Trends we expect to see strong momentum next 12 months.

Return of investment discipline triggers structural decline in funding, UK's share increases and the end of the mega rounds.

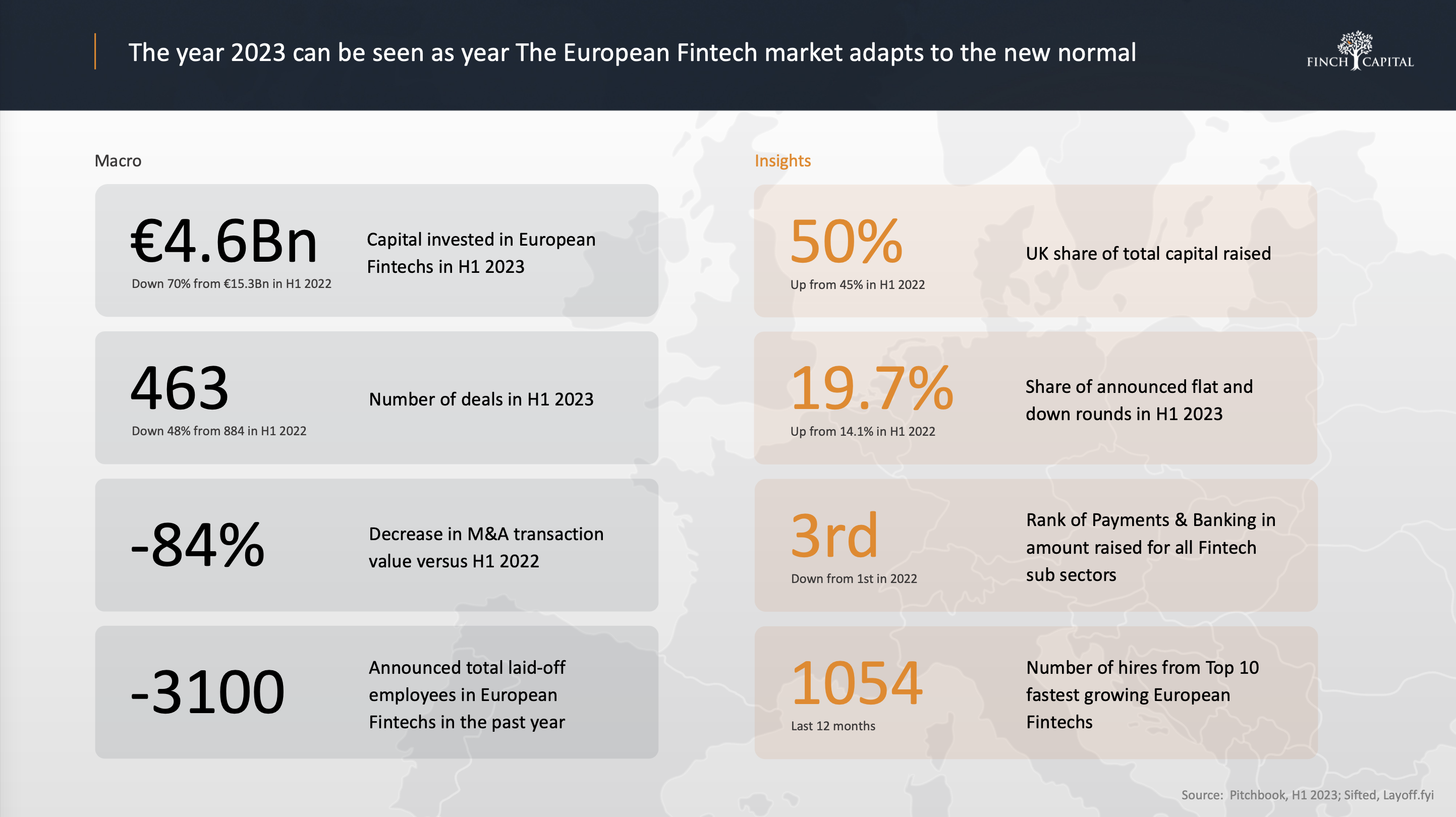

The European FinTech sector has been heavily impacted by the new funding environment, with a total of 4.6Bn capital raised in the first half of 2023, down 70% from 15.3Bn in H1 2022.

In 2021 and 2022, the top 20 funding rounds in Europe accounted for 50% of the market, they are now accounting for over 60% of total deal volume whilst having largely decreased in size. Across the investment ecosystem, the long tail of deals outside of the top 20 have been squeezed in total capital raised, and like any previous cycle corporate investors are retreating in the face of macroeconomic uncertainty. Seed rounds continued to attract funding, but companies in the Series A to C stages got squeezed the most.

Sector wise, the biggest surprise has been in Payments, which traditionally has been a resilient category that saw record amounts of capital deployed in 2022, as investors took caution to the valuation inflation in the sector. Crypto has been the main benefactor as investors flocked to early stage businesses.

Finch Capitals report shows a drop of 70% in funding value across major markets such as the UK, Germany and France, although the share of the UK in the total funding accounted for 50% of the total capital raised in Europe, up from 45%.

US based investors that were active in these markets have also taken a step back. For instance, in 2021, there were 3 US based firms in the top 5 investors in the UK, while in 2023, there were none.

From a valuation perspective, public technology markets have retreated to 2019 levels after record growth in 2020-2021, but are showing some signs of stabilization. The private markets are undergoing a similar but slower transition to 2019 valuation levels. Later stage valuations have fallen much more dramatically having seen in some cases up to a 50% drop. The earlier stage in FinTech has been much more resilient, as valuations have remained relatively flat. There is hope for the ecosystem though, as valuations stabilized in the first 6 months of 2023 from their low in December 2022

These topics are good proxies for the overall health of European FinTech which, as Finch predicted last year, has now entered a period of contraction. Unsurprisingly, there will be losers, but like in every market cycle, there will be winners as well. Laser focus on building profitable businesses at sustainable valuations will drive economic value to all stakeholders in this next phase.

Exit market remains resilient, except for larger transactions

M&A activity was still only down 5%, showing an appetite to do deals at the right prices, however it showed a 84% decline in M&A transaction sizes. Public markets remained closed however, as valuations have bottomed out, and with inflation declining, 2024 could create new opportunities for Europe's highest valued companies to exit, as they are too big to be acquired.

This is all against a backdrop of the M&A market seeing large outcomes decline considerably, with less than 19% of all deals valued over USD 500m and venture funding with megarounds in particular having declined back to 2019 level.

As companies fight for profitability most companies made lay-offs, except half of the European Unicorns, which are expected to start laying off in the second half

The fight for profitability came into real focus in the past year as the industry suffered from more than 3,000 announced layoffs. Despite the backdrop described above, the sector is still hiring, with the 10 fastest growing Fintech companies having hired +1050 people in the past year (50% of employee base). Demonstrating a shift towards a less-well funded and more competitive landscape, some companies have decided to hire for cheaper junior positions and lay off senior sales people that have gotten too expensive over the last few years for todays market conditions.

Review of the key European countries showed that despite the slowdown, the UK markets maturity enables to continue to stand out

Overall, the UK showed more resilience than some others and accounted for over 50% of the funding in Europe. Regions like the Nordics, Poland and France and Nordics held up through some bigger crypto funding rounds, but overall dependence on local early stage investors is prevalent.

The lengthening of time to fund is also particularly felt in markets like Ireland, Poland and Nordics as investors refocus on core local markets with the bar for non-local investors rising to even higher levels than before. Sovereign Fund of Fund Investors like the British Business Bank, Enterprise Ireland, KfW, BPI continue to back funds in the local ecosystem that allowed capital to remain in the market. France for instance, had the largest equity deal of the year with Ledger raising over 400m.

In general, countries with an active Series A-B investor base, such as the UK and France have seen valuations hold up with modest increases in post money valuations.

The trend of a shift to software and B2B FinTech continues in 2023

The shift from consumer FinTech to B2B FinTech has been taking place over the last couple of years and now that trend is here to stay. Lending/balance sheet business in general have been affected, as cost of funding increases and loan portfolios worsen. The saving grace for some of the B2C FinTechs has been the increase in interest rates, which allows a healthy interest income revenue line to exist.

As payment and open banking consolidate, regulation technology is driving increased enthusiasm in the B2B FinTech sector. KYC and AML are becoming complex and further tailwinds from government driven initiatives are resulting in renewed interest from investors. With the generative AI boom, retail banking and insurance seem to be prime candidates for adoption. Finally we expect the CFO to become even more important in an organization and the tools they use will only expand.

Commenting on the findings Radboud Vlaar, Managing Partner at Finch Capital, said: Since mid 2022 we have seen an increase in investment discipline in public and private markets, resulting in less funding, lay-offs, less IPOs, flight to quality and focus on capital efficiency. This will continue to be painful for the next 12 months, but will result in a more healthy and sustainable Start-up, Hiring and Investor ecosystem

With investors bridging overvalued portfolio startups to bring them to profitability and struggling to find attractive exits in a grossly devalued market, we are likely to see a period of consolidation in the FinTech space as many verticals are highly fragmented, creating a smaller but more sustainable ecosystem. We should also start to see a slow recovery of the IPO market in the next semester as valuations have started to slowly pick up and inflation is declining.

Last years shake up with valuations coming down, fundraising slowing down and the exit window closing up, was painful yet necessary. Consolidation and more competitive investment flows, combined with still significant levels of undeployed capital, will bring maturity to the FinTech sector. This new normal level of activity demonstrates the refocus of the FinTech ecosystem on long term sustainability versus short term gains"

About Finch Capital

Finch Capital is a Growth Investor in Europes Biggest Technology Transitions. We currently focus on 6 themes: FinTech (incl. Health and Insurance), Payments, Business Applications (Incl Accounting, Tax), Regulatory and ESG Software and Real Estate Technology. We back companies generating 2m+ in ARR by investing 5 to 15m initially and help them scale to 30m-50m revenues by building sustainable and capital efficient business models. We have invested in 45 companies including Fourthline, Goodlord, Grab, ZOPA, Twisto, AccountsIQ, Nomupay and Symmetrical.

Finch Capital consists of a team of 12 investment professionals with wide entrepreneurial experience located across offices in Amsterdam, London and Dublin. For more information see www.finchcapital.com and subscribe to our newsletter.

Contact Details

Finch Capital

Radboud Vlaar

Finch Capital

Aman Ghei

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/report-the-return-of-funding-discipline-triggered-the-ecosystem-to-fight-for-profitability-to-survive-180409181

Finch Capital

COMTEX_440022305/2655/2023-09-12T02:59:32

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Open Headline journalist was involved in the writing and production of this article.